7 Online Trends to Inform 2025 Growth

As I reviewed the newly released IPEDS data, I was searching for the data and insights that would be most helpful to online program and enrollment leadership in setting a course for 2025. These data, alongside other intelligence gathered over the last several months will enable online leaders to succeed this year as well as plan for the future.

So, what do you need to know?

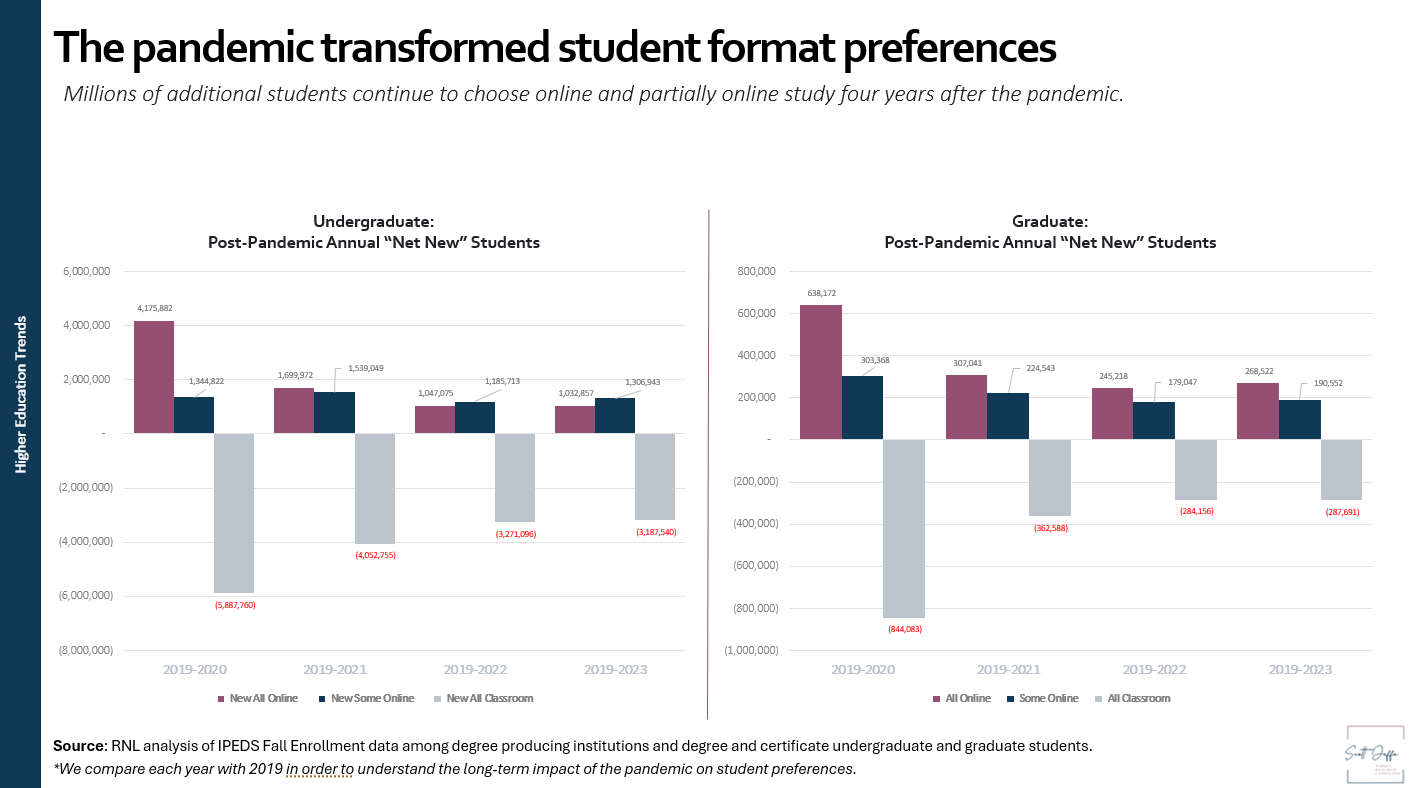

1. Online and partially online enrollment continue to dominate growth. Four years out from the pandemic, the number of students deciding to enroll in either fully or partially online study well out-paces pre-pandemic trends. While year-over-year change each year saw some students “return to the classroom,” not nearly enough have done so to constitute a return to "normal." In fact, when compared with 2019, 2.3 million more undergraduates and 450k more graduate students chose fully or partially online study in 2023-24. Perhaps more important, 3.2 million fewer undergraduates and 288k fewer graduate students are chose classroom-only programs.

My Take: Institutions seeking to grow enrollment must develop processes to quickly determine the best online programs to offer and get them “to market” within 12 months.

Net "new" undergraduate and graduate students by format comparing pre-pandemic data with subsequent years.

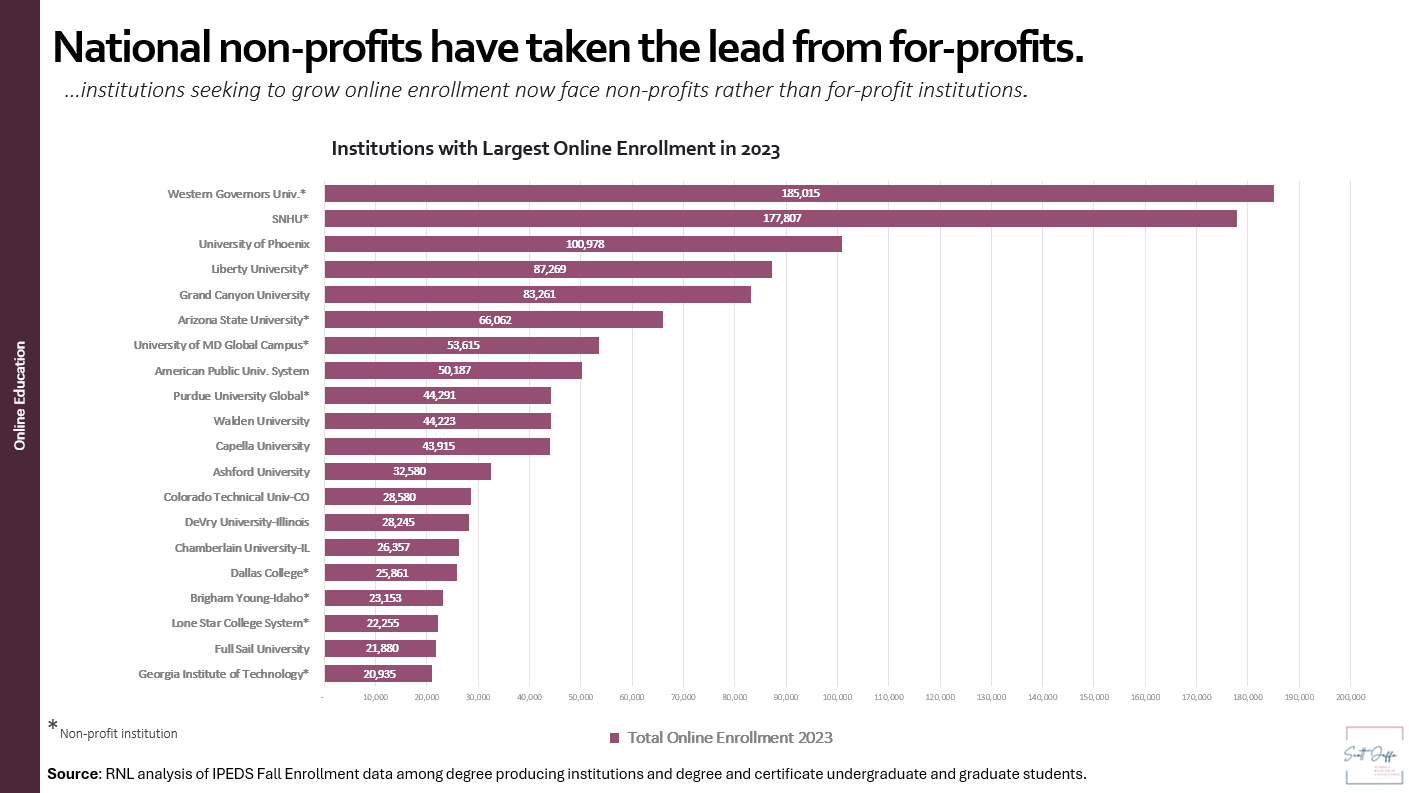

2. Institutions seeking to grow online enrollment are now competing with non-profit institutions. Just five years ago, the strongest competitors in online education were for-profit institutions. In some ways, these institutions were easy to beat (excepting their huge marketing budgets). They had taken a beating in the press to the extent that students knew about it, and they were far away and unknown. Today, institutions face no less of a competitive environment, but the institutions dominating the scene – and most likely a students’ search results – are national non-profits. While these institutions are not local providers to many students, they have not been criticized in the way that eroded interest in the for-profits. Student search engine results are also now filled with ambitious public and private institutions seeking to “diversity their revenue streams.”

My Take: Institutional marketers need to adjust their strategies to focus on this new reality, knowing that they can “win” the student over the national online providers if they ensure that they rise to the top of search results.

Institutions with largest online enrollment - across both levels - in 2023.

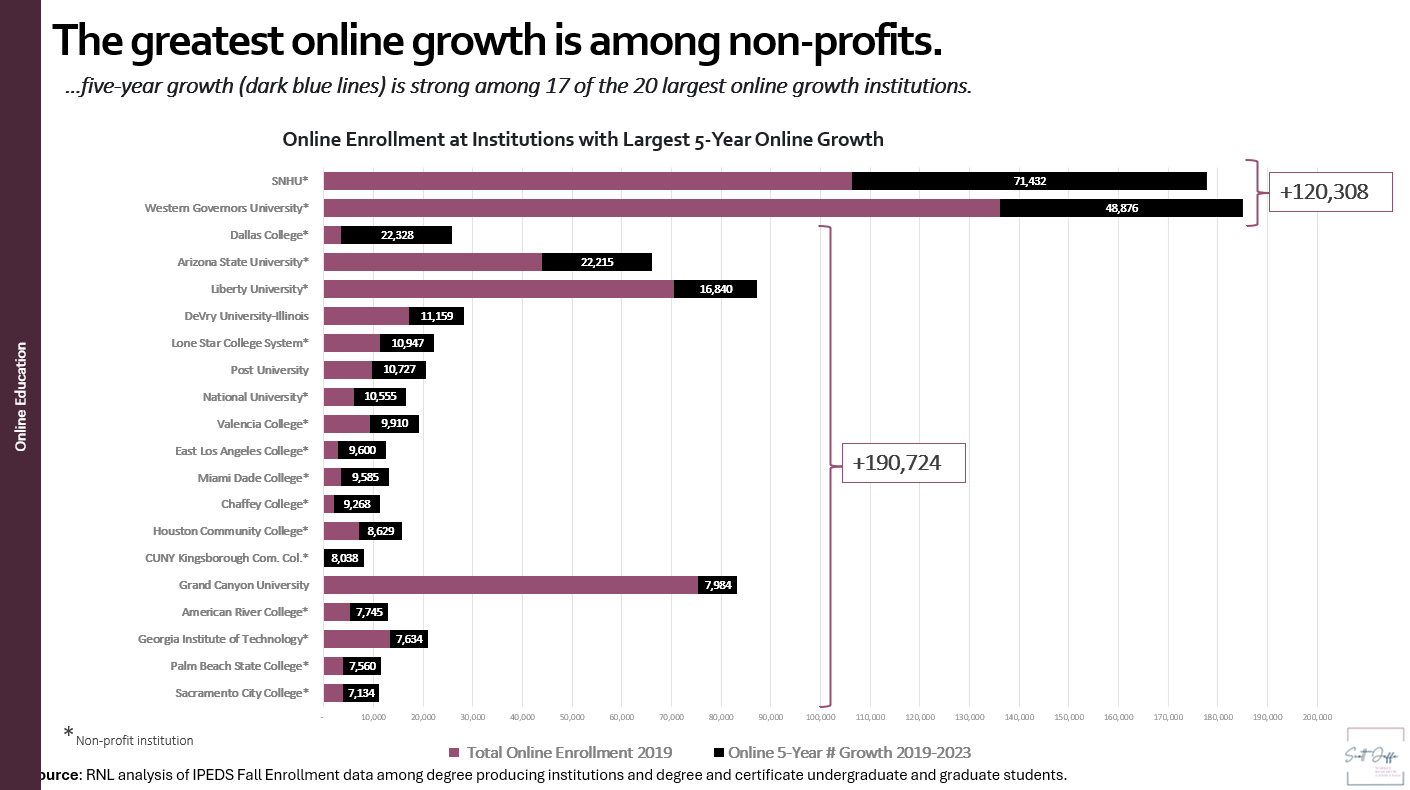

3. Online enrollment growth is being led by non-profit institutions. Seventeen of the 20 institutions reporting the greatest growth in online enrollment over the last five years are nonprofit institutions—a mix of ambitious public and private institutions and national non-profits. What is more, the total growth among institutions after the two behemoths far exceeds Southern New Hampshire University and Western Governors University. These nimble and dynamic institutions include a variety of institution types (with community colleges well represented) across the higher education sector.

My Take: Institutions seeking to grow online enrollment should research what these institutions are offering and how they are positioning their programs in the market and emulate some of their best practices.

20 institutions with largest overall online enrollment growth between 2019 and 2023.

4. New graduate program growth is dominated by online/partially online offerings. In 2024, a study by higher education researcher Robert Kelchen documented growth in available master’s programs over the last 15 years. This study documented massive expansion (over the 15-year period, institutions launched nearly 14,000 new master’s programs on a base of about 20,000), but also that the pace of launching online or hybrid programs dramatically outpaces classroom programs. This rise in available offerings far outpaces the rate of growth of the online student market, resulting in significantly higher levels of competition for each online student.

My Take: Institutions seeking to grow their online footprint must ensure that they fully understand both the specific demand dynamics for each of their programs and the specifics of what online students want in their program. A mismatch on either factor will inhibit growth.

5. Online success is breeding scrutiny of outcomes. We all know something of the power of social media today. This was reinforced for me recently by an Inside Higher Education story which focused on the 8-year rates of degree completion among the biggest online providers. The story was triggered by a widely read Linked IN post and followed up by numerous other stories and posts and comments across the platform. This is just the kind of exposure that is most likely to generate real scrutiny of the outcomes of online learning – which were already taking shape over the last year or more. In fact, this focus on outcomes ended up as one of the unfulfilled priorities of the Biden Education Department.

My Take: Institutions seeking to enter the online space have an opportunity to tackle some of the quality issues that first plagued the for-profits, now challenge the national online non-profits, and will confront others if not addressed soon.

6. Key preferences for online study have been changed by the pandemic. RNL’s 2024 online student survey surfaced dozens of important findings that online leaders should consider as they chart their course. Two findings stand out as reflecting profound changes in online student preferences, and both are likely the result of pandemic-era experiences. First, 89 percent of online students are open to at least some synchronous activities in their program, likely the result of hundreds of online meetings during the pandemic. Similarly, online students now prefer to communicate with online programs during weekday business hours. This is also likely to be related to the pandemic period, in which millions of people working from home began to regularly contend with some personal business during their day.

My Take: Institutions should assess both of these factors as they think through student engagement (to address point #5), and the intense competition of the online space (to address point #3).

7. Contracting institutions are not focusing on online enrollment. Finally, the new IPEDS data make it clear that institutions experiencing the greatest enrollment contraction over the last five years have done very little to add online programming to their offerings. Even where there has been some online or partially online growth, these efforts have not been given adequate attention to counterbalance contraction among students enrolled in classroom-only programs (green lines).

My Take: Institutions facing classroom-only contraction must either amend their goals downward to account for reduced demand or determine which online or hybrid programs would be most attractive to students in their region and then ensure that such offerings are visible in a highly competitive higher education market.

This blog was based on a post I contributed to the RNL blog in January 2025.