The Coming Implosion of International Graduate Enrollment — And Why Domestic Market Clarity Is Now a Survival Skill

For more than a decade, international graduate enrollment has quietly carried a disproportionate share of the graduate education landscape in the United States. Many institutions—some intentionally, others without fully realizing it—have come to depend on international students to stabilize master’s programs, fill revenue gaps, and offset domestic enrollment softness.

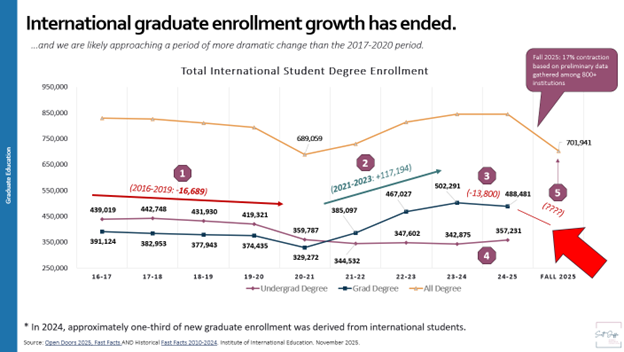

But the newest Open Doors data makes one thing unmistakably clear: That era is ending, and the shift will be both swift and severe.

In a recent conversation with my long-time colleague Jesse Homan, we dug into what is actually happening beneath the headlines, why graduate-heavy institutions should be deeply concerned, and what leaders must focus on next to avoid being blindsided. The data tells a very different—and far more urgent—story than the public narrative suggests.

The Headline Number Is Misleading — Here’s Why: The Open Doors report framed international enrollment as having grown by 4.5%, which may give the impression of a stable or even strengthening market. But that figure includes OPT participants—international graduates working in the U.S. post-completion. OPT is not enrollment and treating it as such masks what the student data truly reflects.

When you separate actual students from OPT, the story changes dramatically:

Undergraduate international enrollment grew by 4.2%, roughly 14,000 students.

Graduate international enrollment contracted by 2.7%, a loss of roughly 14,000 students, canceling out the undergrad gains.

And based on early reporting from more than 800 institutions, Fall 2025 is tracking toward a 17% decline in international enrollment, a COVID-level collapse without a global pandemic driving it.

A 17% contraction is not a course correction. It is the beginning of a structural implosion.

And for institutions that have leaned heavily on international students at the graduate level, this may be the most consequential signal in a decade.

Why This Collapse Will Hit Graduate Programs Hardest: Historically, undergraduate and graduate international trends moved somewhat in parallel. That changed post-pandemic: graduate programs saw explosive international growth while undergraduate numbers recovered far more modestly.

That surge was never sustainable.

Over the first three years of the Biden administration, graduate programs added more than 117,000 international students nationally—accounting for about one in three new graduate students each year. Now, with even modest policy barriers, visa uncertainty, and shifts in global perception, the market is correcting. And because the graduate-level spike was so outsized, the decline will be equally outsized.

This is not about being anti-international. It is about acknowledging a rapidly changing reality: Graduate schools built on international enrollment are entering a period of acute vulnerability.

The Consequence No One Is Talking About: Domestic Competition Is About to Explode. The most damaging impact of the international decline is not the lost international students themselves. It’s what happens next. Every institution losing international graduate students will turn their attention immediately—and aggressively—to the domestic market.

That means:

Programs that rarely competed with each other will suddenly be operating in the same domestic pool.

Institutions that previously relied on international volume to stabilize revenue will now pursue domestic students with unprecedented intensity.

Even institutions with

small

international populations will feel the squeeze as others move onto their turf.

In other words: The implosion of international graduate enrollment does not just shrink the international market; it dramatically increases competition for domestic students. Most institutions are not prepared for this.

The Strategic Question Every Institution Must Be Able to Answer. In conversations with institutional leaders, I often hear something like: “We aren’t heavily international, so this doesn’t really affect us.” It does—because the moment your competitors lose international students, you become part of their domestic strategy.

Which is why the most important question for graduate programs right now is not: “How do we rebuild international enrollment?” But rather: Do we genuinely understand our domestic graduate audience?

Who are they?

What motivates them to pursue graduate education?

What are their barriers—financial, personal, logistical, or psychological?

What do they expect from modality, pacing, advising, and outcomes?

And most importantly: Why would they choose us over an institution now actively competing for the same students?

Domestic market clarity is no longer optional. It is a survival skill.

The Institutions Best Positioned to Weather This Will Be the Ones That Pivot Early. The data tells us that the international decline is not temporary, rhetorical, or cyclical. It is structural, and its effects will be long-term.

This means institutions that want to remain competitive must:

Deepen their understanding of local and regional domestic demand.

Reassess program portfolios with a domestic-first lens.

Align pricing, pacing, and modality with what today’s adult learners actually want.

Strengthen employer partnerships and career-aligned value propositions.

Build enrollment strategies that no longer assume international enrollment as the stabilizing force.

The institutions that make this pivot now—before Fall 2025 numbers are finalized—will be the ones that maintain graduate stability in the decade ahead.

Those that don’t may find themselves reacting to a shrinking market with too little information and too little time.

Final Thought: Clarity, Not Panic

This is not a call to abandon international recruitment. It is a call to recognize that the landscape has shifted and will not return to its previous trajectory anytime soon.

Graduate programs can absolutely remain strong—but only if they:

Accept the reality of the international contraction,

Understand that domestic competition is about to intensify, and

Invest deliberately in understanding and serving today’s domestic learner.

The institutions that thrive in this new era will be the ones that stop relying on yesterday’s assumptions and start designing for tomorrow’s reality.